capital gains tax philippines

The regular income tax for individuals remains at 32. This tax applies to the sale price and does not have a holding period.

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

It is their only source of capital gains in the country.

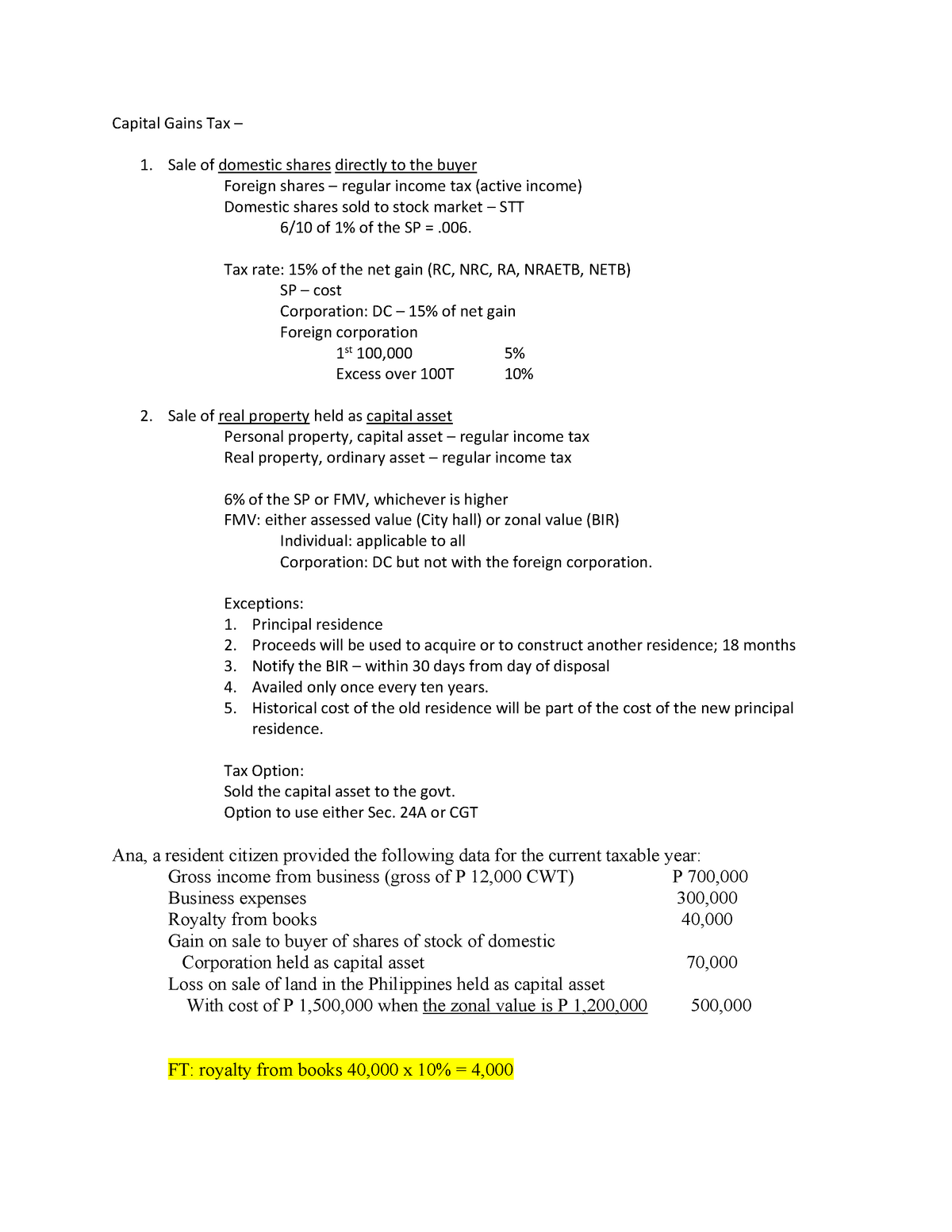

. The tax charge is 5 for the. NRI Advisory Services provides Income Tax Return in Philippines with an excellent reputation for delivering world class services If you are searching for Capital Gains Tax Philippines then. The Philippine tax code imposes a six-percent capital gains tax on the gross selling price of real estate.

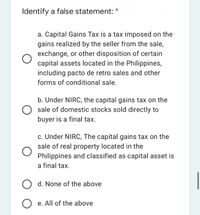

Remember that the Capital Gains Tax is. File tax returns within 30 days after each sale or disposition of. Sale of capital assets subject to capital gains tax CGT c.

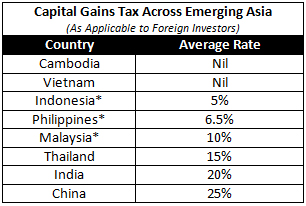

One good example of it is your house and lot or primary residence up for sale. Under Republic Act No. Taking a look at the capital gains tax rates in Philippines compared to other countries in the Asia.

In computing the capital gains tax due on the sale of the principal residence we follow the following steps. For example if the property is. The property was worth US250000 or 250000 at purchase.

If your propertys selling price is higher than its fair market value it will be used as the base for computing the Capital Gains Tax CGT. National Tax Research Center. For amounts less than or equal to P100000- 5 For amounts more than P100000- 10 DEADLINE.

It has appreciated in value by 100 over the 10 years to sale. Capital gains not subject to CGT are subject to basic tax. Tax Information Index for Capital Gains Tax Description Capital Gains Tax for Onerous Transfer of Real Property Classified as Capital Assets Taxable.

So the capital gains tax can apply to any capital asset that increases its value over time. Which means the price of the shares of inventory offered and incidental promoting bills are to be deducted for capital positive factors tax functions. It is not their sole.

Capital gains subject to capital gains tax a. Computation of Capital Gains Tax in the Philippines. To calculate the capital gains tax you check the value of the property or its current fair market value whichever is higher and multiply that by 6.

1 Determine the percentage of non-utilization applying the. According to section 24c of the national internal revenue code of the philippines nirc the capital gains tax rate of six percent 6 is based on the gross selling price or current fair market value. 9337 the RCIT is now 30 on net taxable income beginning on January 1 2009 down from 35.

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Income Tax And Capital Gains Rates 2019 03 01 19 Skloff Financial Group

Capital Gains Tax Pdf Pdf Capital Gains Tax Taxpayer

Solved Please Note That This Is Based On Philippine Tax System A Course Hero

How Are Capital Gains Taxed Tax Policy Center

Solved With An Explanation Of Every Detail On How You Come Up With The Course Hero

Answered Identify A False Statement A Bartleby

The Rough Guide To The Cost Of Business In China Compared To Asia China Briefing News

Capital Gains On Selling Property In Orlando Fl

How To Compute Capital Gains Tax Train Law Youtube

Capital Gains Tax Sample Problems Capital Gains Tax Sale Of Domestic Shares Directly To The Studocu

Lecture 04 Capital Gains Tax On Real Property Dealings In Property Income Taxation Youtube

What S Your Tax Rate For Crypto Capital Gains

Doc Capital Gains Tax Is A Tax Imposed On The Gains Presumed To Have Been Realized By The Seller From The Sale Via Neslyn Palencia Academia Edu

Capital Gains Taxes Are A Type Of Tax On The Profits Earned From The Sale Of Assets Such As Stocks Or Real Estate 7742572 Vector Art At Vecteezy

Capital Gains Tax Deferral Capital Gains Tax Exemptions

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Philippine Income Taxation Inclusion And Exclusion Of Gross Income Course Hero